Publisher Bloomsbury sets special dividend as lockdown reading boosts earnings By Reuters

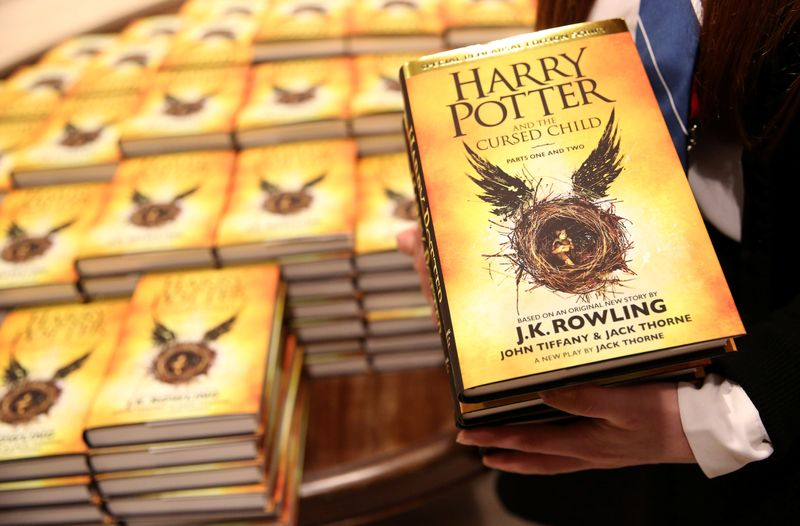

(Reuters) - London-based Bloomsbury Publishing declared a special dividend and posted a 22% surge in annual earnings on Wednesday, as people turned to books during COVID-19 lockdowns. The Harry Potter publisher, which also expects current-year results to be ahead of market estimates, said profit before taxation and highlighted items rose to 19.2 million pounds ($27.17 million) in the 12 months to Feb. 28 from 15.7 million pounds a year earlier. ($1 = 0.7066 pounds) ...

Continue reading